According to the BERNAMA news, ‘New cigarette price for 20 sticks set at

RM 7 from September 1 2012’.

According to the news, Malaysia

Health Minister Datuk Seri Liow Tiong Lai said Malaysia Government has decided

to set a price floor for the 20 sticks pack cigarette due to the increase in

demand of cigarette. In this world, cigarette is inelastic goods. The reason

why cigarette is an inelastic good is because the quantity demanded for

cigarette will never have a huge change compare to the change in price. The

equation to count the elasticity of a good is the percentage changed in

quantity demanded over the percentage changed in price.

Price floor is a regulation that

makes it illegal to trade at a price which is lower than a specified level. The

objective of setting a price floor to cigarette is to reduce the consumption of

cigarette because the more you take cigarette the more easily you destroy your

health. It goes same to wine, beer and alcohol drink. These goods are also

inelastic goods because they will be numbers of citizen who are still willing

to purchase no matter how high had the price changed. In the elasticity of

demand stated that the closer the substitute product is, the more elastic is

the demand for it. Therefore, cigarette is an inelastic good because it got

only a little numbers of substitute goods. Price floor which is set above the

equilibrium price will only bring a little changed to the quantity demanded for

cigarette because it is an inelastic good. In microeconomics stated that, the

more inelastic demand of a good, the more slanting the curve is. So, when the

price floor is set above the equilibrium price, the will only be a little

changed in quantity demanded. In my opinion, the way to reduce the consumption

of cigarette is to setting an anti-smoking campaign.

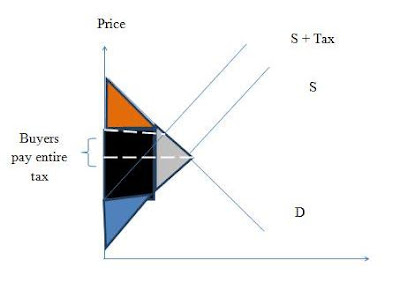

From the graph above, we can see that if the price floor is set above

the equilibrium price, there will be a surplus in market. But because the price

is set above the equilibrium price, there will be an underproduction in

cigarette which will bring the solution to the surplus in market.

Tax incidence is the tax division of

the burden of a tax between buyers and sellers. In microeconomics, it stated

that if a good is an inelastic good then the tax will be pay by the buyers.

Vice versa, if a good is an elastic good, then the tax will be pay by the

sellers. In this case, cigarette is an inelastic good so the tax is pay by the

buyers.

After a price floor is set, there will be a market failure which is

underproduction. A price floor drives a wedge between the buying price and the

selling price and results in inefficient underproduction. The price buyers pay

is the buyers’ willingness to pay which is measures as marginal social benefit.

The price sellers receive is also the sellers’ minimum supply-price, which is

equal to marginal social cost. Therefore, if the market is underproduction,

this will solve the surplus in the market. Price floor makes marginal social

benefit exceed the marginal social cost, shrinks the producer surplus and

consumer surplus, and creates a deadweight loss. An underproduction is a

deadweight loss to the social. The reason why an underproduction will cause

deadweight loss is because the condition does not fulfill the people in the

market. Additionally, after price floor is set, smokers who are low income

earner will look for a cheaper cigarette. In this situation, smokers who are

looking for the cheaper cigarette will find a black market. Black market is a

market where buyers and suppliers will have trade activity behind the real

market which is control by the government. In cigarette market, smokers are

looking for suppliers who are willing to sell cigarette with cheaper price

compare to the cigarette market. On the other hands, suppliers who are in black

market are looking for smokers who are looking for cheaper cigarette. Buyers

and suppliers who are having trade activity in black market will cause

deadweight loss to society. When buyers are looking for cheaper cigarette in

black market will do some survey and this might cost them. This cost is known

as opportunity cost. Vice versa, sellers who are looking for buyers in black

market will have to do some survey also. Thus, opportunity costs incur.

From the graph above, the grey region represent the deadweight loss

occurred. The brown area shows the consumer surplus and the blue area represent

the suppliers’ surplus. The black region shows the tax revenue earn by the

government.

In the market of cigarette, demand

is inelastic. After a tax is added into the price of cigarette, the price will

be higher than previous. Although the price of a cigarette have increase, but

the quantity bought will not change. Due to the inelastic demand, the buyer

will pay the entire tax which is added by the government to the cigarette.

In conclusion, when a price floor is

set for an inelastic good then it will never have a larger change because buyer

for inelastic good will never have a large respond toward the price changed. In

my opinion, if the price floor is higher, smokers who are low income earner

will have no effort to buy cigarette. Thus, rate of crime in social might

increase because smokers have to rob others to get money to buy cigarette for

satisfaction. To reduce the consumption of cigarette, there is not only setting

anti-smoking campaign but also do advertising on effects of smoking on the box

of the cigarette.

0 comments:

Post a Comment