Taxes and subsidies. Taxes are something that can

increase the price paid by the buyers and lower the prices received by the

sellers. So when the taxes decrease the quantity produced, it leads to

underproduction. Taxes can be incidence with the elastisity if the demand and

the supply when the division between buyers and sellers depends on the

elasticities of demand and supply.

Subsidies are a payment that the government give to

the producer which can decrease the prices paid by buyers and increase the

prices received by the sellers. Subsidies can lead to overproduction when they

increase the quantity produced.

Externalities. An externality is a cost or a benefir

that effects someone other than the seller or buyer. It can become

overproduction when the external cost arises and it become underproductionwhen

the external benefit arises.

A public good is a good or service that is consume

simultaneously by everyobe even if they do not pay for it. A market would be

underproduce national defense because it is in each person’s interest to free

ride on everyone else and avoid paying for the good that has been shared. A

common resource is owned by no one buy it is available to used by everyone. It

can be overused when in everyone’s self interest to ignore the costs they

impose on others when they decide how much common the resources to use.

Monopoly become one of the obtacles because it is a

firm that provides a good or service. It becomes underproduction when a

monopoly produces too little and charges too high to achive its goals.

A price ceiling is a charge that the government give

to the producer to make the price higher from the specified level. When a price

ceiling is set above the equilibrium it has no effect and the market works in

efficient way. But when the price ceiling is set below the equilibrium, it has

a powerful effect. A price ceiling can cause a black market where is an illegal

market that operatees alongside a legal market in which a price ceiling or

other restriction has been imposed.

According

to Fintan Ng that local prices are expected to remain

stable in August even as food prices soared abroad in the wake of a severe

draught hitting parts of the United States and Europe alongside rising energy

prices that can make subsidies and

price caps continued to mask inflationary pressure in the country, which had

experienced a drop in its consumer price index (CPI) since the beginning of the

year and they also expected

Bank Negara

to keep the key policy rate at 3% for the rest of the year as concerns over

growth outweighed inflation expectations.

The food

price increase because of the occurrence of inflation and the amount of money

in circulation. The occurrence of inflation in which is increase or rise in the

price of goods or services in a given period. Usually this happens during the

period with respect to the moment or event such as Hari Raya and Christmas.

For the

amount of money in circulation, this is because the earlier consumptive of the

citizen that makes them withdraw their funds that already been deposited for a

long time. And with those funds held over sometime makes people

"confused" to use it. Because it is simultaneously

make a certain item for the shoppers to assault it. Consequently,

according to the economic laws, as more and more requests then the price will

rise. If a stock available, it will rise under control and at a reasonable

range, if it is not then the price will increase dramatically even sometimes it

will become effects in the social events.

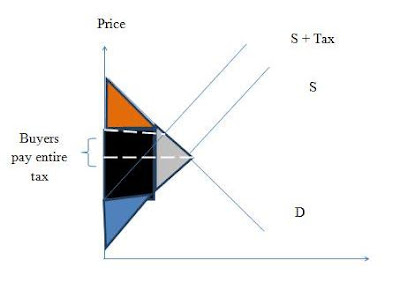

When the

food price is perfectly inelastic demand, the buyers pay the entire tax such as

the service tax in the restaurants and when it is perfectly elastic demand, the

sellers pay the entire tax. The more inelastic the demand, the larger is the

buyer’s share of the tax. But if there is no tax, the marginal cost of the food

is equal to the marginal social cost and that makes the market become efficient

but not for the production subsidies because at the quantity of food produced,

the marginal social benefit is equal to the market price which has fallen so

the production subsidies become inefficient and overproduction.

If the

marginal social benefit of the food is exceed the marginal social cost, so the

tax is inefficient because the tax revenue takes part in the total surplus and

the quantity of the food become decreased. So the marginal social benefit of

the food has increased or exceeded that make the production subsidies become

inefficient and over production. The production subsidies are overproduction in

the two situations above that make a market failure to the food, and the price

also increase higher than the original price before the subsidies happen to

them and the price expectations of inflation will also become a concern for the

rest of the year.

Original article link: http://biz.thestar.com.my/news/story.asp?file=/2012/9/18/business/12040573&sec=business